Collateral Issues Are Third Most-Likely Cause of Mortgage Loan Denial

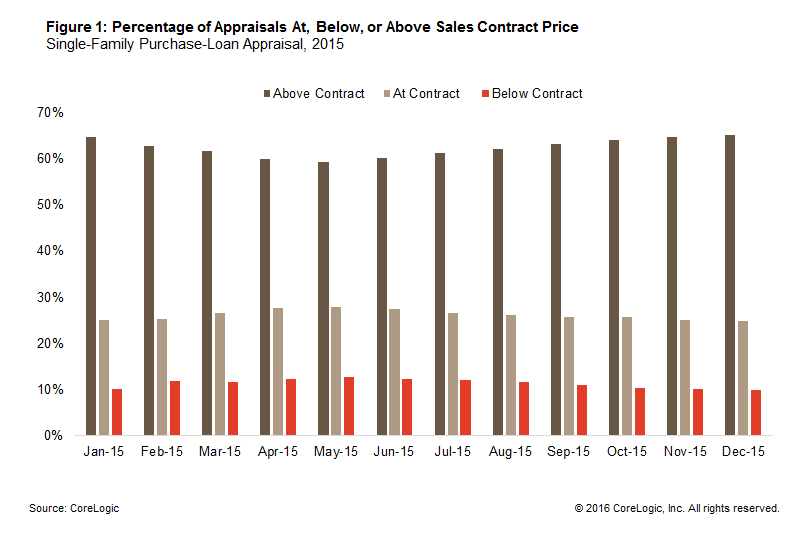

About 10-13 Percent of Appraisals are Below Pre-Closing Contract Price According to newly released 2015 Home Mortgage Disclosure Act (HMDA) data, collateral was the third most-frequently cited reason for denials of mortgage loan applications, or 13.7 percent on first-lien purchase mortgages for one-to-four family, owner-occupied homes – trailing distantly behind denials citing applicant’s debt-to-income ratio […]

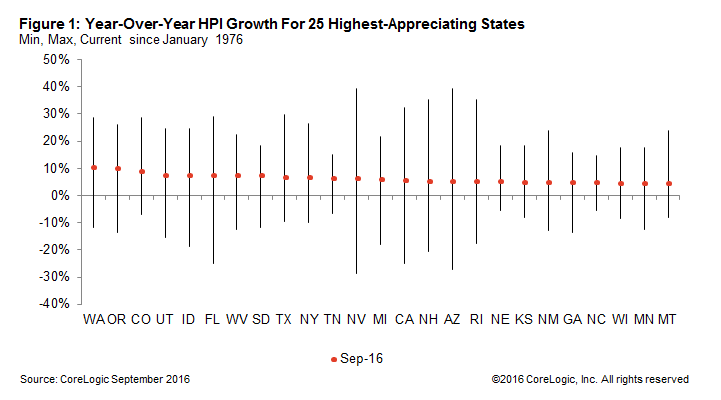

National Home Prices Increased 6.3 Percent Year Over Year in September 2016

Home prices forecast to rise 5.2 percent over the next year. The highest appreciation was in the West, with Oregon and Washington growing by double digits in September. After adjusting for inflation, home prices are still 19.1 percent below their peak. National home prices increased 6.3 percent year over year in September 2016. While the […]

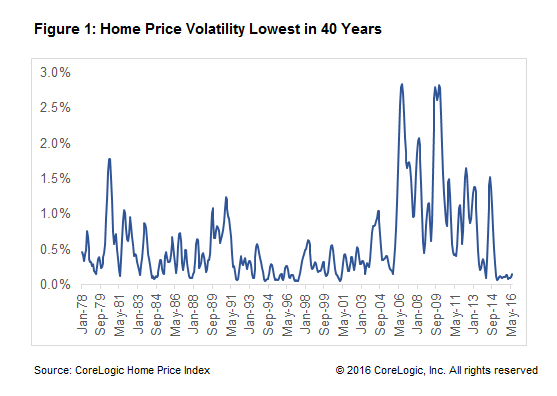

Current Home Prices the Most Stable During the Last 40 Years

Volatility has roiled the U.S. and global financial markets for some time. June’s Brexit vote, for example, was the most volatile day in the history of foreign exchange markets. Likewise, the huge influx of foreign capital drove longer-dated Treasury maturities to record lows. But one market seems to have escaped these gyrations: U.S. housing. There […]

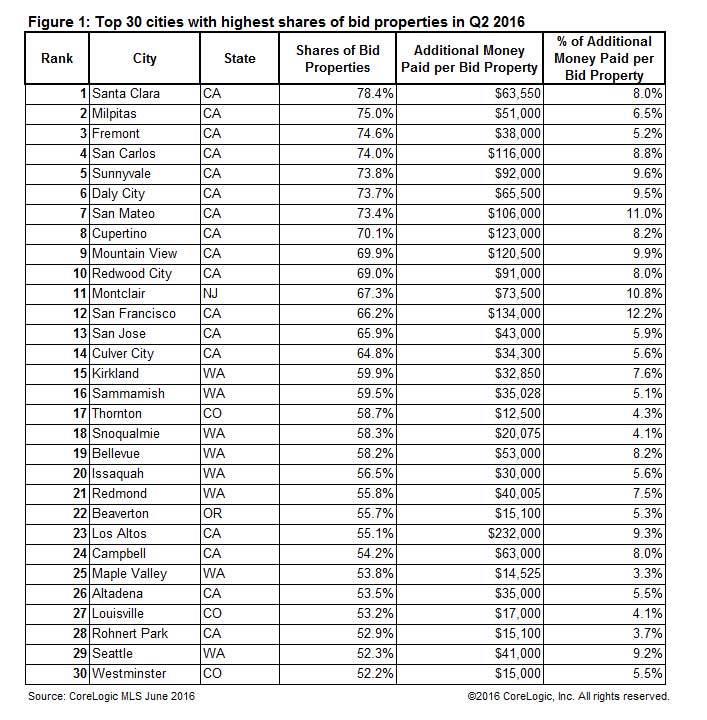

Home-Bidding Wars Heating Up

When demand is high and supply is low, home-bidding wars can break out and push home sale prices above their listing prices. In some of the hottest housing markets buyers are bidding against each other to pay more for homes. Using more than 700,000 home sales closed in Q2 2016, new analysis from CoreLogic shows […]