The Roaring 20’s – Centennial

After a century of ups and downs, the “Roaring 20’s” are perhaps taking shape all over again. Prior to the Corona Virus placing a temporary stronghold on our world’s economy, the United States’ economy was in overdrive. More Americans were making more money than ever before. The U.S. was setting a remarkable new benchmark for […]

Good News for Real Estate! – Tax Reform headed to the President

Lawmakers in the House and Senate passed tax reform legislation today, paving the way for the bill to go to President Donald Trump for his signature. The President has said he intends to sign the bill by Christmas. NAR worked with members of the House-Senate conference committee to help educate them on how to improve the […]

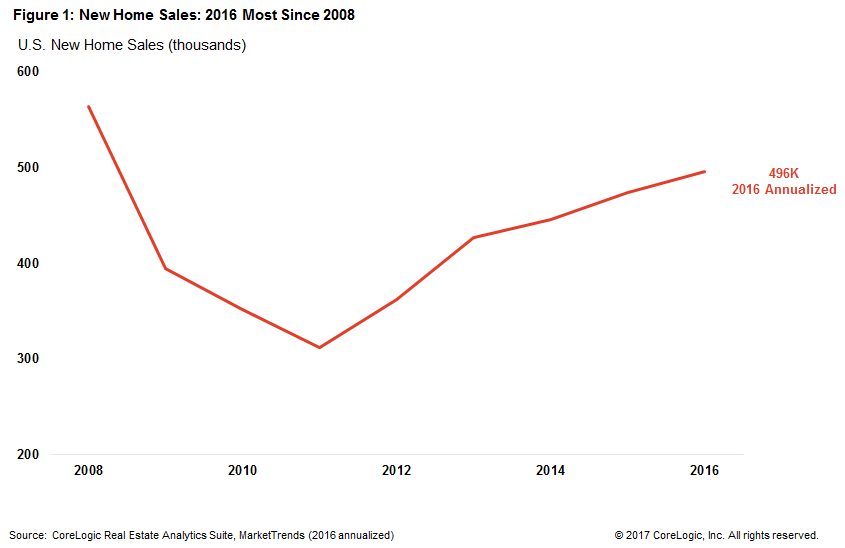

New-Home Sales Up for Fifth Straight Year

Low mortgage rates, job growth, and an improving consumer optimism have all supported the recovery in home sales during the last few years. Both sales of newly built as well as previously owned homes are up, with the growth stronger for new homes. Since the trough in new-home sales in 2011, sales had jumped more […]

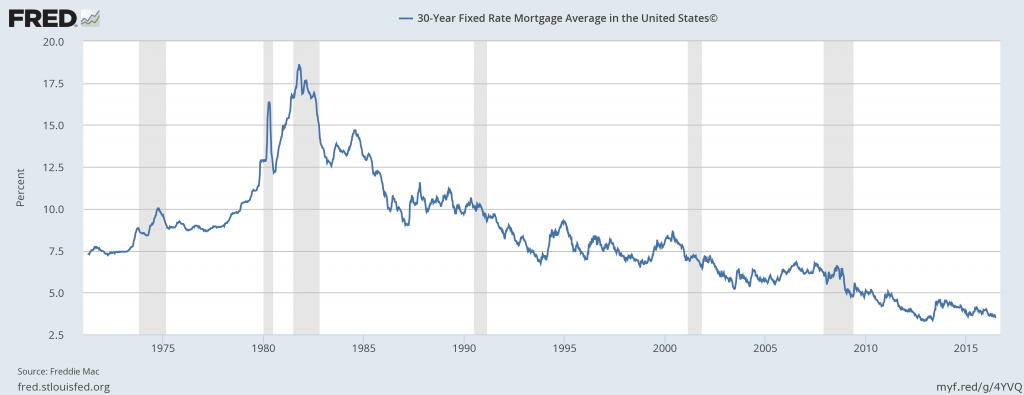

Rising Mortgage Rates Not Stopping Borrowers

The monthly mortgage cost of a San Diego County Home has gone up $177 since the election, but that hasn’t stopped people from wanting to buy. Applications were up 12% in November compared to the same time last year, the Mortgage Bankers Association reported. But, that was down 3% from October. So are people concerned […]

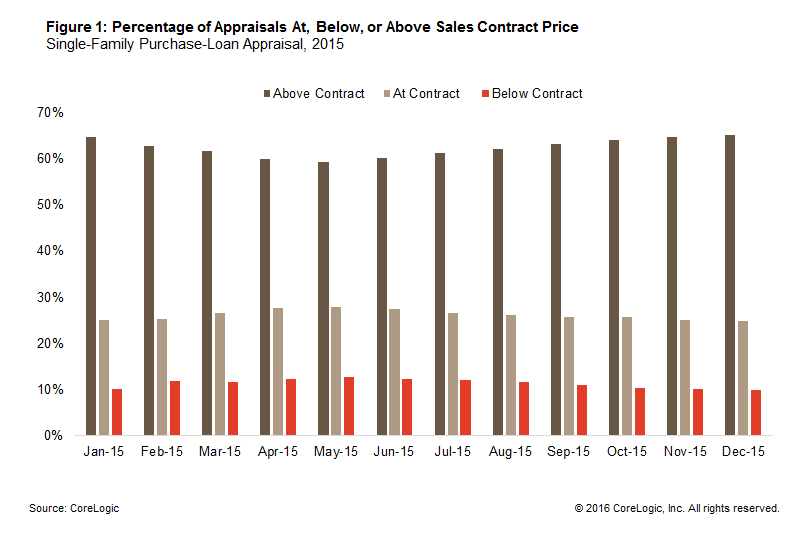

Collateral Issues Are Third Most-Likely Cause of Mortgage Loan Denial

About 10-13 Percent of Appraisals are Below Pre-Closing Contract Price According to newly released 2015 Home Mortgage Disclosure Act (HMDA) data, collateral was the third most-frequently cited reason for denials of mortgage loan applications, or 13.7 percent on first-lien purchase mortgages for one-to-four family, owner-occupied homes – trailing distantly behind denials citing applicant’s debt-to-income ratio […]

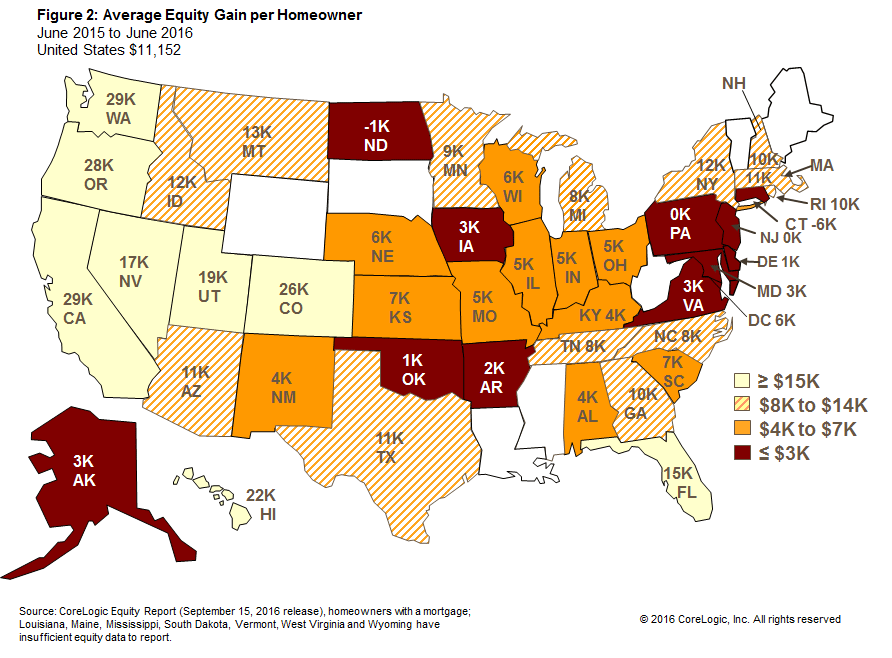

Home-Equity Wealth Makes a Comeback

Home prices have risen significantly throughout the nation since the 2011 trough in the housing cycle. The Home Price Index has recorded a 40 percent rise in the national index since the trough, with some areas up more sharply and other markets showing a more subdued bounce back.One outcome of the broad geographic recovery in […]

U.S. Economic Outlook: July 2016

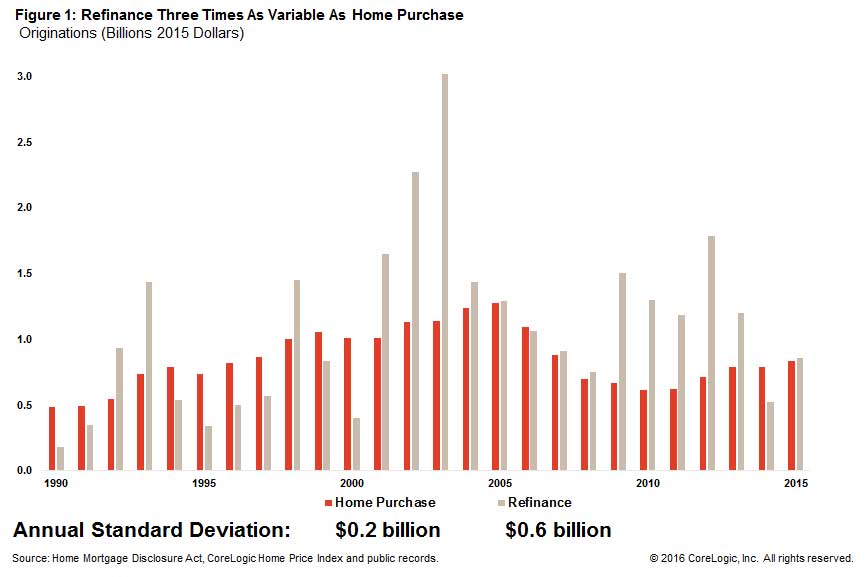

For most of the last 25 years, large annual swings in home mortgage originations have been common, driven by a refinance boom-and-bust cycle. And while refinance will continue to be an important segment of the market, home purchase is expected to dominate the lending landscape in the coming years. What this means for the lending […]

Proof the housing market can survive a Fed interest rate hike

The reason behind the drop in mortgage apps Although mortgage applications significantly tumbled this week, the Federal Reserve’srecent interest rate hike is not to blame, according to a new report from Capital Economics. Capital Economics originally forecasted back in December that the housing market could withstand a rate hike, with this new Mortgage Bankers Association report giving early evidence that it was right. […]