About 10-13 Percent of Appraisals are Below Pre-Closing Contract Price

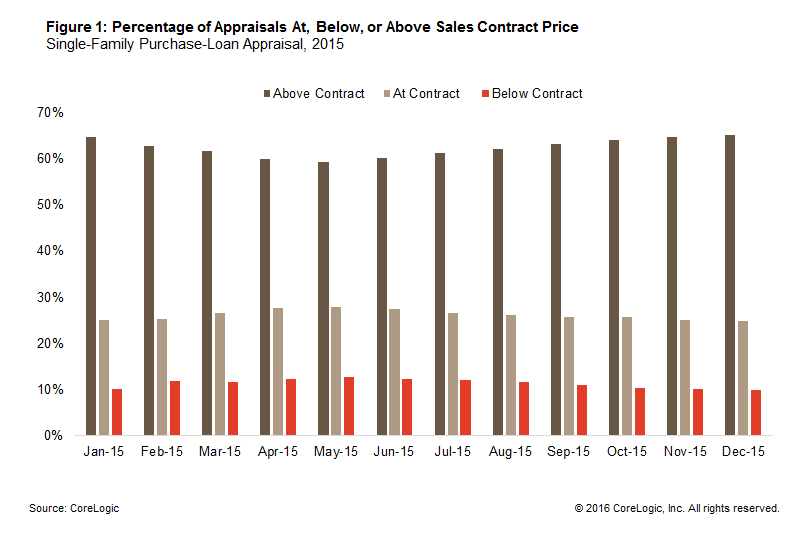

According to newly released 2015 Home Mortgage Disclosure Act (HMDA) data, collateral was the third most-frequently cited reason for denials of mortgage loan applications, or 13.7 percent on first-lien purchase mortgages for one-to-four family, owner-occupied homes – trailing distantly behind denials citing applicant’s debt-to-income ratio (23.4 percent) or credit history (20.4 percent). The collateral-related denial rate was up slightly from 12.9 percent in 2014. Lenders denied these purchase-loan applications because the value or type of collateral was not sufficient, presumably because an independent, third-party appraisal could not support the buyer’s and seller’s agreed-upon sales price of the home in most of these cases. The HMDA numbers were spot on. When millions of purchase-loan appraisals have been analyzed each year since 2010, below-contract appraisals – that is, when appraised collateral value falls below the pre-closing sales contract price – typically hover narrowly in the 10-13 percent range, while the rest are either identical to the sales contract price (27-30 percent) or higher (60 percent). In 2015, below-contract appraisals made up 11.3 percent of the single-family, first-lien purchase-loan appraisals ordered through CoreLogic/FNC’s Collateral Management System – an appraisal workflow and compliance platform used by many U.S. mortgage lenders, servicers and appraisal management companies. During the late-spring and early summer seasonal upswing in home sales and prices, there is typically a small decline in the share of appraisals above the contract price, and accordingly, a small increase in the share of below-contract appraisals, which is reversed in the latter half of the year.

There are several reasons why an appraisal value may come in below the buyer-and-seller’s negotiated price. In today’s seller’s market where homes sell quickly and bidding wars have become commonplace in many of the nation’s largest housing markets during the last few years, there is a good chance that the winning bidder may have overpaid for the home. Similarly, when buyers fall in love with the design or unique custom features a home has to offer and are more than willing to pay extra for personal preference, appraisers may not attach as much value to these non-standard features as the buyers out of concern for their broader appeal and marketability upon future resale.

At other times, the appraisal may fall short because home prices in the local market area might be rising quickly but the data appraisers rely on have not fully kept up with the market. Although appraisers are supposed to make “date of sale” or market trend adjustments on past comparable sales, it is likely that the adjustments may be inadequate in keeping up with a fast-rising market. Given rapid price acceleration in many markets during 2014 to 2015, some appraisals may have insufficiently adjusted for market price movements.

The majority of the below-contract appraisals are within 10 percent of the contract price: Of the 11.3 percent that were below-contract appraisal in 2015, 8.3 percent came in below the contract price at no greater than 10 percent. Only about two in 100 appraisals, or 2.1 percent, came in below the contract by more than 10 percent. For appraisals that were below the contract price, the median difference between the two was 4.5 percent with a median contract sales price of $218,000.

Real Estate in San Diego's North County — Adam Foley — DRE #01973295

Real Estate in San Diego's North County — Adam Foley — DRE #01973295

Leave a Reply

You must be logged in to post a comment.